The Indian government is planning a big relief under the Goods and Services Tax (GST) system, especially for the middle class and lower income groups. According to sources, the government is considering reducing the 12% GST slab to 5% for many commonly used items. This move is aimed at lowering the cost of everyday goods and helping families manage expenses better.

Major Items May Become Cheaper

If the proposal is approved, many daily-use items currently taxed at 12% could soon be taxed at only 5%. This includes products like shoes and slippers, sweets, clothing, soaps, toothpaste, and dairy products. These are items used widely by average Indian households. Lowering the tax will make these goods more affordable.

Next GST Council Meeting May Finalize Move

This major decision is expected to be discussed in the 56th GST Council meeting, which could take place later this month. The council includes representatives from both the central and state governments. If a final decision is made, the tax cut could be implemented soon after.

Everyday Items That May See GST Cut

Some of the items that might be moved from the 12% to 5% GST slab include:

-

Footwear under ₹1000

-

Ready-made clothes

-

Packaged sweets

-

Toothpaste and soaps

-

Paneer (cottage cheese), dates, and dry fruits

-

Pasta, jam, and packaged fruit juice

-

Namkeen (salty snacks), umbrellas, and caps

-

Cycles and wooden furniture

-

Pencils, jute/cotton handbags and shopping bags

This list includes many household goods that are essential for daily living.

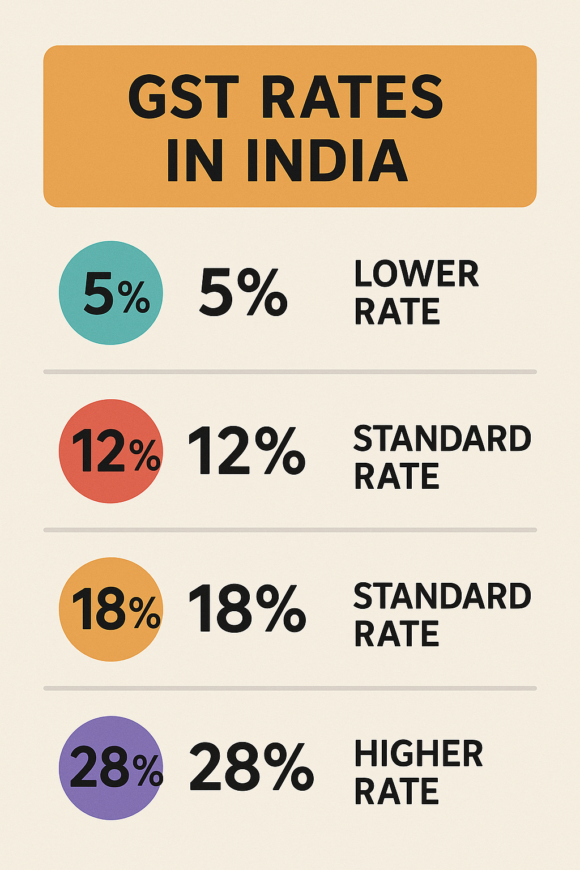

Four GST Slabs Exist in India

India currently has four main GST slabs: 5%, 12%, 18%, and 28%. These were introduced in 2017 when the GST system was launched. Each category of goods is placed under a slab based on its necessity or luxury status. For example, essential items like food grains and cooking oil are in the 5% slab, while luxury goods and sin items are in the 28% slab.

Government Had Earlier Hinted at Changes

The government has been hinting at making the GST structure more simple and consumer-friendly. Finance Minister Nirmala Sitharaman mentioned in March that once the rationalization process of GST slabs is complete, further rate cuts would be possible. This current move is seen as part of that broader reform.

Move to Help Fight Inflation

If implemented, the GST rate cut will help reduce the prices of essential goods. This will bring direct financial relief to households, especially those affected by inflation and rising living costs. It can also boost consumption, helping the economy in the process.

Final Decision Awaited Soon

As the country waits for the next GST Council meeting, expectations are high. A reduction in GST rates for commonly used products would be a welcome move for millions of families. If approved, this will mark a major step towards a fairer and more supportive tax system for everyday consumers.