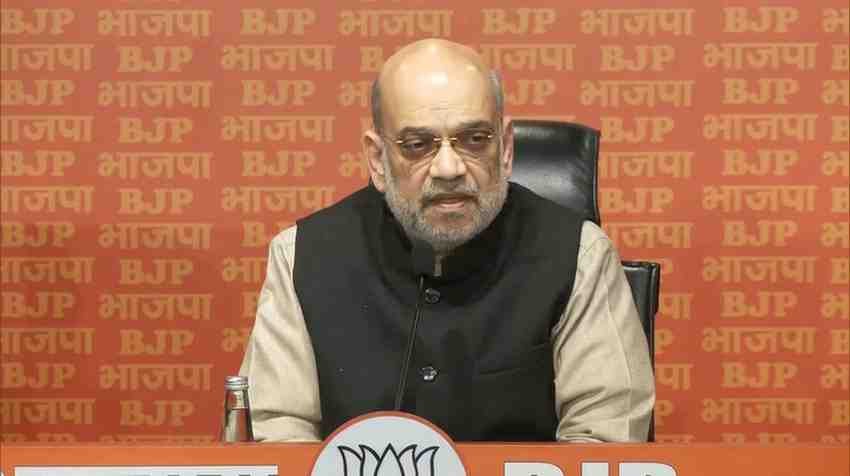

In a show of support for Finance Minister Nirmala Sitharaman’s recent budget address, Home Minister Amit Shah praised the government’s commitment to the middle class, highlighting a significant tax reform that exempts individuals earning up to ₹12 lakh from income tax. Shah took to social media to express his approval, emphasizing that Prime Minister Narendra Modi has consistently prioritized the needs of the middle class.

In his statement, Shah remarked, “The middle class is always in PM Modi’s heart. Zero Income Tax till ₹12 Lakh Income. The proposed tax exemption will go a long way in enhancing the financial well-being of the middle class. Congratulations to all the beneficiaries on this occasion.” His comments reflect a broader sentiment within the government that aims to alleviate the financial burden on middle-income earners.

The announcement of the new tax structure is part of Sitharaman’s comprehensive budget plan, which she described as a blueprint for the Modi government’s vision of a developed India. Shah commended both the Prime Minister and the Finance Minister for their efforts, stating that the Budget 2025 represents a forward-thinking approach to governance and economic development.

Sitharaman’s budget, presented in her seventh consecutive Lok Sabha address, included a reorganization of tax slabs that directly benefits the middle class. By raising the income tax exemption threshold to ₹12 lakh, the government aims to provide significant financial relief to millions of taxpayers. This move is expected to enhance disposable income, thereby stimulating consumer spending and contributing to economic growth.

In addition to the tax reforms, Shah noted that the budget outlines a series of next-generation changes aimed at modernizing various sectors. Key proposals include increasing the foreign direct investment (FDI) cap in the insurance industry, simplifying tax legislation, and reducing intermediary fees. These measures are designed to create a more conducive environment for investment and economic activity, ultimately benefiting the broader population.

The Home Minister’s endorsement of the budget underscores the government’s commitment to fostering a robust economic framework that supports the middle class while also addressing the needs of various sectors. By prioritizing tax relief and investment in welfare programs, the Modi administration aims to create a more equitable economic landscape.

Shah’s remarks resonate with the sentiments of many middle-class citizens who have long sought relief from the financial pressures of rising living costs. The government’s focus on enhancing financial well-being through tax exemptions and increased support for welfare initiatives is expected to be well-received by the electorate.

As the government moves forward with the implementation of these budgetary measures, the emphasis on middle-class welfare and economic development will likely remain a central theme in its policy agenda. The positive reception of Sitharaman’s budget by key government figures like Amit Shah signals a unified approach to addressing the challenges faced by the middle class and fostering a thriving economy.

In conclusion, the recent budget presented by Finance Minister Nirmala Sitharaman has garnered significant praise from Home Minister Amit Shah, who highlighted the government’s commitment to the middle class through substantial tax reforms. With a focus on enhancing financial well-being and promoting investment, the Modi government’s budget is poised to make a lasting impact on the economic landscape of India.